cost comparison: CYA VS Health Insurance

We believe CYA paired with free market healthcare is a better alternative to health insurance for many Americans. You'll save thousands of dollars per year while having the freedom to spend on whatever healthcare you want, from traditional medicine to salsa dance immersions.

We believe CYA paired with free market healthcare is a better alternative to health insurance for many Americans. You'll save thousands of dollars per year while having the freedom to spend on whatever healthcare you want, from traditional medicine to salsa dance immersions.

Let's look at a couple side-by-side comparisons:

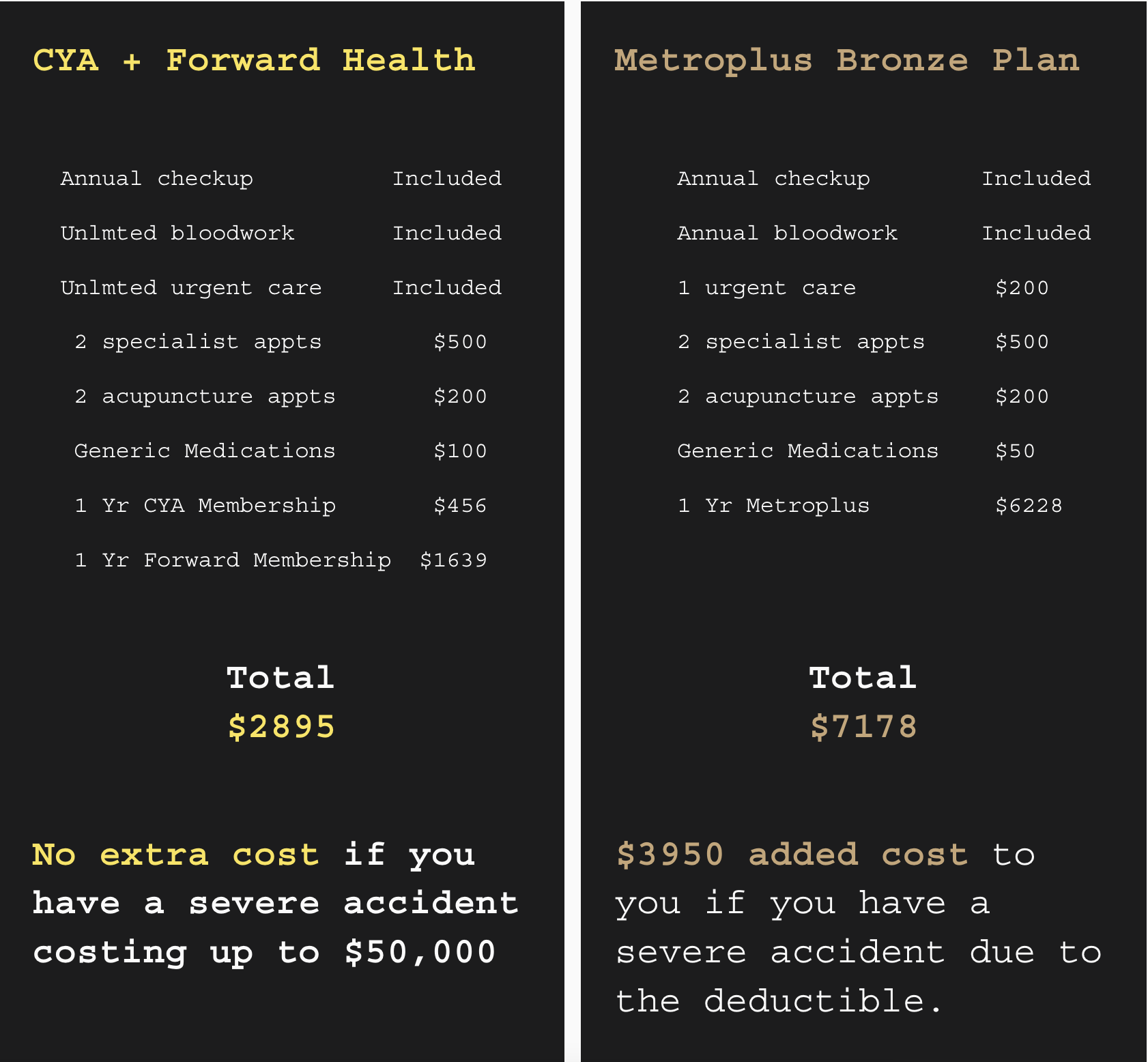

Example: Annual Medical Cost Estimates for a generally healthy person, CYA + Self Pay vs Metroplus Bronze, the lowest cost health insurance you can find in NY if you are over 30.

Highlights:

CYA + Self Pay can be 3.5x less expensive than Metroplus Bronze if you don't have an accident, and 5x less expensive if you have a bad accident

CYA + Self Pay gives you freedom to get the health care you want without a middleman in a far away office deciding for you

Who's this good for? Individuals and Small Businesses who are tired of wasting money on health insurance they don't use, and want to save cash while keeping their freedom of choice of healthcare

Example: Annual Medical Cost Estimates for a generally healthy person, CYA + Forward vs Metroplus Bronze, the lowest cost health insurance you can find in NY if you are over 30.

Highlights:

CYA + Forward can be 2.5x less expensive than Metroplus Bronze if you don't have an accident, and 4x less expensive if you have a bad accident

CYA + Self Pay gives you freedom to get the health care you want without a middleman in a far away office deciding for you

Who's this good for? Individuals and Small Businesses who want consistent and frequent access to primary, preventative and urgent care who are tired of wasting money on health insurance they don't use, and want to save cash while keeping their freedom of choice of healthcare.

Health Insurance OPTIONS FOR SMALL BUSINESSES

Wondering what the best health insurance option is for your small business / startup company that won’t break the bank? Read on legend…

Its open enrollment time! Are you wondering what health insurance you are going to provide your employees without breaking the bank?

1. Traditional Health Insurance Plans

The Big Players: UnitedHealthcare, Blue Cross Blue Shield, and Aetna. These are like the Hollywood A-listers of health insurance. Expensive, a bit high-maintenance, but they deliver the red carpet experience.

Cost: As predictable as a plot twist in a soap opera. Expect premiums to range from "Yikes" to "Are they serious?" per employee per month.

Estimated Minimum Premium: Think Broadway premiere tickets, about $400 to $600 per month.

Typical Deductible: Like the cost of a decent laptop, generally around $1,000 to $2,000.

Pros: Comprehensive coverage. Like having a security team for your health.

Cons: Costly. Requires a degree in rocket science to understand policies.

2. Health Maintenance Organizations (HMOs)

The Deal: It's like having a VIP pass, but only for certain clubs (healthcare providers).

Cost: More wallet-friendly. Think off-Broadway show prices.

Estimated Minimum Premium: More like a ticket to an off-Broadway show, around $300 to $450 per month.

Typical Deductible: Often lower, akin to a fancy dinner in the city, around $500 to $1,500.

Pros: Lower premiums and out-of-pocket costs.

Cons: Limited provider network. If you go out-of-network, it's like showing up at a party you weren't invited to.

3. Preferred Provider Organizations (PPOs)

The Plot: Pay more, get more freedom. Choose your healthcare provider like choosing a restaurant for dinner.

Cost: A bit like splurging on a fancy dinner. Higher premiums, but more choices.

Estimated Minimum Premium: Comparable to a weekend getaway, about $450 to $600 per month.

Typical Deductible: Can vary widely, but think of it like a high-end smartphone, around $1,000 to $2,500.

Pros: Flexibility in choosing providers.

Cons: Higher costs. Like paying for backstage passes.

4. Health Savings Accounts (HSAs)

The Twist: Not insurance, but pairs with high-deductible plans. It's like having a piggy bank for health expenses.

Cost: Depends on your deductible plan, but HSAs have tax advantages.

Estimated Minimum Premium: Like snagging a deal on designer shoes, could be as low as $250 to $400 per month.

Typical Deductible: This is where it gets real – think of a nice used car, usually around $2,000 to $6,000.

Pros: Control over spending, tax benefits.

Cons: High deductibles. Like buying a concert ticket but still having to pay for each song.

5. CYA (Cover Your you know what)

The Indie Option: Not health insurance. It's a community that catches you when you fall (accidentally).

Cost: A flat $38 per month. No plot twists, no cliffhangers.

Flat Rate: Still the indie film subscription of the bunch, a neat $38 per month.

No Deductible: The plot twist here? No deductibles. What you see is what you get.

Pros: Affordable, simple, great for reducing overall insurance spend.

Cons: Limited to accidents. Won't cover if your actor falls ill, only if they fall off the stage.

Conclusion

Choosing health insurance for your startup or small business is like casting for a movie: you need to find the right fit for your budget and needs. Traditional plans offer comprehensive coverage but at blockbuster prices. HMOs and PPOs give you varying degrees of choice and cost. HSAs offer a tax-savvy way to manage expenses. And CYA? It's the indie darling for those who want basic financial security for accidents without the drama of high costs. Remember, these figures are more of a teaser trailer than the full feature. Actual costs can vary based on the script – I mean, factors like location, plan specifics, and company size. Always do a table read – or in this case, consult with an insurance expert – before the final act.

Remember, in the end, it's all about keeping your cast (employees) healthy and ready for action without breaking the bank (or a leg, but if you do, make sure you're covered.)

sup FEAR?

This weekend I stumbled upon FDR's Four Freedoms on Roosevelt Island: Freedom of speech. Freedom of religion. Freedom from want. Freedom from fear. It reminded me of why I started CYA...

First off, I’m under the thinking that no emotion is “bad”. Every emotion gives us useful information that we can better our lives with. So sorry Franklin, we should’t do without fear, rather we should learn what to do WITH fear.

The fear emotion signals potential danger. Think of it as an alarm, like a smoke alarm, that when triggered, wants to be addressed until the perceived danger is assuaged.

Seems obvious that we would want to address the fear alarm, right? I mean, who wants to live with a never ending alarm bell ringing inside our bodies, putting our nervous systems in constant stress? Alas, thats what many of us do :(.

Leaving the fear alarm ringing disrupts our inner peace. A constant nag that draws our attention away from joy and appreciation, towards anxiety and stress.

That unaddressed fear also prevents us from being ourselves. From being different. From being outside the mainstream. From taking risks. From striving. From pursuing an extraordinary life.

The alternative to ignoring the fear is to address the fear head on, by saying “sup fear?” Like, “I see you fear, what are you all about?” with curiosity and a “can do” mentality to address it!! 🥳

So how do we address fears so we can turn off the fear alarm and go back to thriving?

Well, some fears we can meditate or think away, like fear of failure. It is possible to rationalize away a fear that is deemed to be “not that big a deal”. But not all fears are created equal. Some fears are related to severe, imminent consequences that if left unaddressed, lead to bodily harm or financial ruin. An example of this is medical expenses. When we are uninsured or underinsured in America, personal bankruptcy due to medical costs is all too real a possibility. (Medical costs are the #1 cause of personal bankruptcy in America.)

This is a fear that ought to be addressed through a real world act, not just contemplation.

Some strategies are really unfortunate. How many of us are stagnating in our safe, yet lame jobs, "because of the health insurance?" How many of us are holding back from going out on our own because we don't want to be left with overly expensive, unreliable health insurance?

If we had a cost effective alternative to health insurance, what would we do differently? Would we take a shot at making our hobby into our profession? Would we have more mental fortitude to continue pursuing our passion knowing we are covered?

Imagine a world where we all are able to live with inner peacefulness, where we address our fear alarms so they don't rule our minds and bodies. Imagine a world where we feel at ease to pursue that which inspires us, and brings us fulfillment and meaning.

I believe this world is a more harmonious world, and one worth striving for. This is the world we are supporting with CYA.

How to negotiate hospital bills

Hold your ground, and don’t give up 💪

You ever get one of those hospital bills in the mail and just wanna cry "WTF?!"? Yeah, me too. But don't worry, I've got some tips for how to negotiate that sh*t and maybe save some cash.

Don't pay that bill right away. Take a deep breath, you've got time. Hospitals usually send out their first bill a month or two after your visit. And even if your bill does go to collections, you've got another 12 months before it can affect your credit score. So don't freak out, give yourself some time to figure things out.

Get an itemized bill. The hospital bill you got in the mail is probably just a summary that doesn't give you much info. To really understand your charges and negotiate your hospital bill, you'll want an "itemized bill" with line items and codes that you can cross-reference. You're legally entitled to receive one within 30 days of asking for it, so call the hospital's billing department and request one.

Look for errors or inflated charges. This is where an itemized bill comes in handy. Compare prices to the market rates for similar services on sites like BlueBook, and make sure you weren't charged for something you didn't actually receive. Look for duplicates, and make sure you weren't billed for the same thing more than once.

Negotiate that sh*t! I mean, why pay what they are asking if the market rate is considerably lower?! Oh helll no. Offer them some guaranteed cash money up front if they give you a DEEP discount. It’s no uncommon to get discounts of over 50%.

So there you have it, my fellow CYAers - four tips for negotiating your hospital bill. Just remember to take it slow, don't pay right away, and make sure you've got all the info you need to get the best deal possible. Good luck! (or just join CYA and we’ll do all of this for you)

how can i use CYa?

Wondering what CYA is for and how to use it? Read on…

UPDATED 12.18.23

Some of us just want to cover our asses for a reasonable price, and then have the freedom to pick and choose healthcare as we need it.

By covering your tush with CYA and going cash pay (ie pay for healthcare yourself), people save thousands of dollars per year while also preserving their freedom of choice in healthcare.

You can refer to our other post comparing costs of CYA vs traditional health insurance.

So what does going cash pay mean? Simply put, it just means you pay for heathcare services yourself vs expecting an insurance company to do it. By saving thousands per year by opting out of health insurance, you free up cash to spend on the things you value most for your health + wellness. From acupuncture to salsa dancing vacations, you know better than Big Insurance on what makes you healthy.

Cash pay works throughout the country, and guess what? Doctors LOVE cash pay. Why? Because they are guaranteed cash up front without having to bicker with an insurance billing department that denies 20% of claims. Ultimately they just wanna get paid and help you be healthy.

Let’s explore some cash pay options.

Primary Care + CYA is a winning combination for people who identify as generally healthy* who want to stay healthy AND be protected should $hit hit the fan. A great model for Primary Care we have seen is Direct Primary Care, ie, subscription to primary care through individual practices or companies like Parsley Health, Mira Health, Forward Health, One Medical and more that provide unlimited primary care services for $75-$150 per month.

There are also great self pay / cash pay search tools out there like Sesame Care and Tripment Health for one off services like MRIs or surgeries. Link2Labs provides deeply discounted prices for lab work. GoodRx and Honeybee are great for discount prescription meds.

There are also a plethora of telehealth resources for Primary Care as well as Specialty Care like SkyMD where you can get a tele-dermatology appointment for just $70, or Betty Health for your primary care needs.

Again, we believe that you are the best person to pick your own doctors, alternative medicine and wellness activities, not an insurance company that will give you generic one-size-fits all solutions where the good one’s are high in demand with limited availability. Lame!

Your wellness journey is personal, whether it be salsa vacations in Colombia, meditation, healthy eating apps, or plant medicine, we think you are best to make those choices and find the best solution for you -- of course we can make recommendations if you ask :)

Have questions about this? Message us!

*For people who are heavy utilizers of health care, likely with a chronic condition and pricey procedures are better off using CYA in addition to Health Insurance. Do your own research!

Origin story

Health Insurance blows. We’ve all experienced it. And yet there is a another solution that goes back the roots of what insurance was supposed to be: community driven.

The dreaded F word. Fear. It’s gotten a bad rap these days as the inhibitor of authenticity, the preventer of pursuing our dreams. And it’s true, fear can absolutely hold us back from striving for more in our lives.

I, for one, am a big believer in living an enlivened life.

Though while some fears are alleviated through a simple mindset shift, other fears require actions in the external world to give us the peace of mind we need to thrive.

For example: if I get hit by a bus, and I’m without health insurance in America, I will be up Schitt’s creek with medical bills.

And sometimes health insurance isn’t even enough, particularly for small business owners, self employed, and other types of independent workers.

Case in point: my dad, who had a stroke last year, had to immediately go back to work in order not to lose his business. It was tough.

I’m convinced that no amount of meditation will help me fully alleviate the fear of going medically bankrupt due to a freak accident or sudden disease.

So what’s the solution to alleviate this most valid of fears?

Health Insurance. Why does the mere mention of that thing make me cringe on the inside? Well, besides the fact I don’t want to imagine being hospitalized or included as one of the “sick ones”…I also think about how damn expensive it is, how shady health insurance companies are, and how they make you feel like a mooch in your biggest time of need and deny claims 20% of the time leaving you with a massive bill to deal with anyway.

I know I’ll be overpaying because they are middlemen needing to feed their large operation, and frankly, most of what they cover I don’t need. I’m a generally healthy person in my mid 30s, thankfully don’t go to the doctor for much more than an annual checkup and the occasional telehealth visit for something that pops up. I know Big Insurance isn’t telling me up front ultimately what will and will not be covered. I also know that there are likely hidden fees in there somewhere a la Southwest Airlines, and that if heaven forbid I have a terrible health issue at some point it's going to really suck dealing with them.

So Eff them! But eff me if I don’t have them 😇. So the only option I have is to pick the lesser of two evils…seems like we’re always doing that these days.

Option 1) Do nothing, live with fear

Option 2) Do something, live with less fear and deal with a shitty experience

But wait. Are there really only two options? Do I really need to hold my nose, sign up to Health Insurance, and immediately try to forget the mediocre choice I just had to make?

I went on a research extravaganza to see what else was out there, exploring alternative models to health insurance including COBRA, short term insurance, and even Christian health shares.

It all seemed overly complicated. I mean, what’s the big deal about insurance anyway? Isn’t it literally just a bunch of us agreeing to donate to one another when we need it?

The fact that Health Insurance is a massive $1 trillion industry is absurd given how simple it can be, particularly when employing modern technology and cutting out the massive bureaucracy of health insurance.

Introducing CYA

CYA is a members club that pays cash and fights hospital bills when catastrophic $hit happens.

$38 monthly membership. Join anytime.

Donations are 100% pre-committed, decentralized. 50% of your monthly membership are held in your CYA account and earmarked for donations to other members, and will never be used by CYA for any reason other than payouts to qualifying Members.

Cash payouts for accidents (+ critical illness). So when costly medical expenses unexpected things happen, the community's got your back, 100%.

Accident Payout: $200 Urgent Care, $5k Emergency Room, $10k Outpatient Surgery $50k Inpatient (hospitalization)

Critical Illness Payout: COMING SOON

Fast, cash transfers. Receive lump sum of cash within 48 hours for medical costs or anything else.

Hospital bill negotiation. We use technology and trained medical bill negotiators to help negotiate down your hospital bills anywhere from 30-85%!

In a nutshell, CYA gives you peace of mind that for any bad thing that can happen that results in medical expenses, we will support you. Period. What this also means is that we aren’t focusing on providing financial assistance for your acne treatments, cosmetic surgeries, or maternity. This is really meant to be a safety net for when $hit hits the fan.

If you identify as one of the following, CYA could be a great fit for you :)

Independent worker (self employed, freelancers, gigster) who need to secure their own healthcare coverage

Small business owners wanting to get some cover themselves and offer an affordable benefit for your employees

People in between jobs who no longer are covered by your employer

Employee with a high deductible plan who wants more coverage “just in case” without having to reach the deductible

Users of Direct Primary Care / primary care (Parsley, Forward, Mira) that want to supplement primary care with ‘catastrophic’ coverage

Foreigner visiting the US from abroad for an extended period and need your ass covered ‘just in case’

Students not fully covered by your university

Adventurous people who want better coverage, particularly if your current plan doesn’t cover adventure sports or international medical expenses

Uninsured people who want some basic Cover Your Ass coverage

With a health care system that is downright unsustainable, we need to seek new, alternative solutions that are affordable, and give you the peace of mind required to live your life fully.

Live boldly, and we’ll cover your ass!

David